|

| image by google.com |

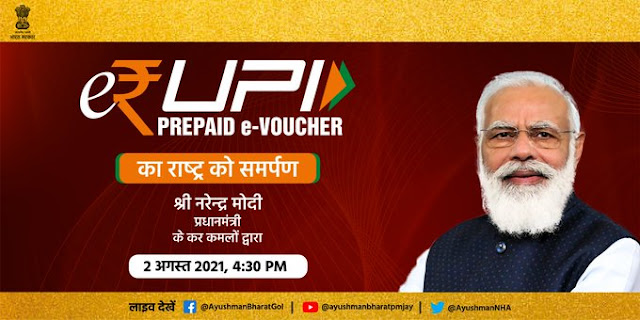

The future of money and payments is digital. Keeping this in mind, India The Prime Minister of Narendra Modi launched the e-RUPI on Monday, 2nd August.

It is being considered as an important step towards digital payment system for the country.

This system is 'end-to-end encrypted' between the sender and the receiver, i.e. there is no interference of any third between the two parties.

It has been developed by National Payment Corporation of India (NPCI).

It is an umbrella organization for operating retail payment and settlement systems in India.

It is an initiative of Reserve Bank of India (RBI) and Indian Banks' Association (IBA).

What is e-RUPI?

According to NPCI, e-RUPI is a cashless and contactless platform for digital payments. It works as an e-voucher based on QR code or SMS.

According to NPCI, users of this one-time payment will be able to redeem the e-RUPI voucher without having to use a card, digital payment app or internet banking access.

This e-RUPI is believed to be easy and secure, as it keeps the details of the beneficiary completely confidential.

The entire transaction process through this voucher is considered relatively fast as well as reliable, as the required amount is already in the voucher.

|

| image by google.com |

benefits

Under many of its schemes, the government has been transferring cash to the poor and farmers in their bank accounts as assistance, as shown in the Corona period.

There is a lot of interference of government employees in this system. Sometimes people also have a lot of trouble with this. There are also allegations that government employees also take bribes.

The use of e-RUPI eliminates this risk, as the Prime Minister's Office said in a statement that the payment system "ensures that the benefits reach the beneficiary without any hassle."

e-RUPI can be used during the special currency help of the government. Private companies can also use it for their employees.

For example, if your company has decided to give an additional payment of Rs 500 per employee in the month of September in addition to your salary, then it can be done through an e-RUPI voucher, under which the company will send a message to your mobile phone or Can be sent in the form of QR code.

Whether the voucher was used in this or not, it can also be tracked.

PM Modi has been a big and ardent supporter of digital wallets and digital payment systems. In a tweet on Sunday, he said that digital technology is changing lives in a big way and increasing the 'ease of life'.

cashless society

The PM had claimed to eliminate illegal cash and make India a cashless society by implementing demonetisation in 2016. But later he spoke of a less cash society and system. Also they have always promoted digital wallet

But according to a recent report by Deloitte, 89 percent of India's total transactions in 2020 took place in cash, while in China 44 percent of transactions took place in cash. The Prime Minister's digital push has not been very successful so far, but financial experts say e-RUPI is a positive step in this direction.

The government's estimate is that as the use of cheap-priced smartphones increases, the use of digital wallets in the country will also increase.

At present, the use of digital wallets like Paytm, PhonePe, Amazon Pay, Airtel Money and Google Pay is becoming common in the country's famous digital wallets.

|

| image by google.com |

Digital currency a global trend

e-RUPI is also being seen as a step towards launching the digital form of Rupee, which is currently called Lakshmi. China has also taken initiative in this and has launched its currency Yuan in digital form in many cities in many cities.

It aims to launch its digital yuan currency called e-RMB nationwide at the time of the 2022 Beijing Winter Olympics. People coming to China in 2022 may have to buy and sell in e-RMB virtual currency.

Bitcoin is currently the largest cryptocurrency in the private sector. The biggest difference between RBI's Lakshmi and cryptocurrencies like bitcoin is that Lakshmi will be under government control while cryptocurrencies like bitcoin remain outside government control.